News

|

Shape Divider - Style fan_opacity

|

What Is Charity Scoring, and Why Does It Matter?Effective Charity Scoring Helps

|

|

Want to know more?

If you want to know more about how the professionals at Reliant can help your practice be more efficient and proactive with charity care services . . . |

Sources:

Featured Image: Adobe, License Granted

Health Journalism

Healthcare Finance News

Transunion

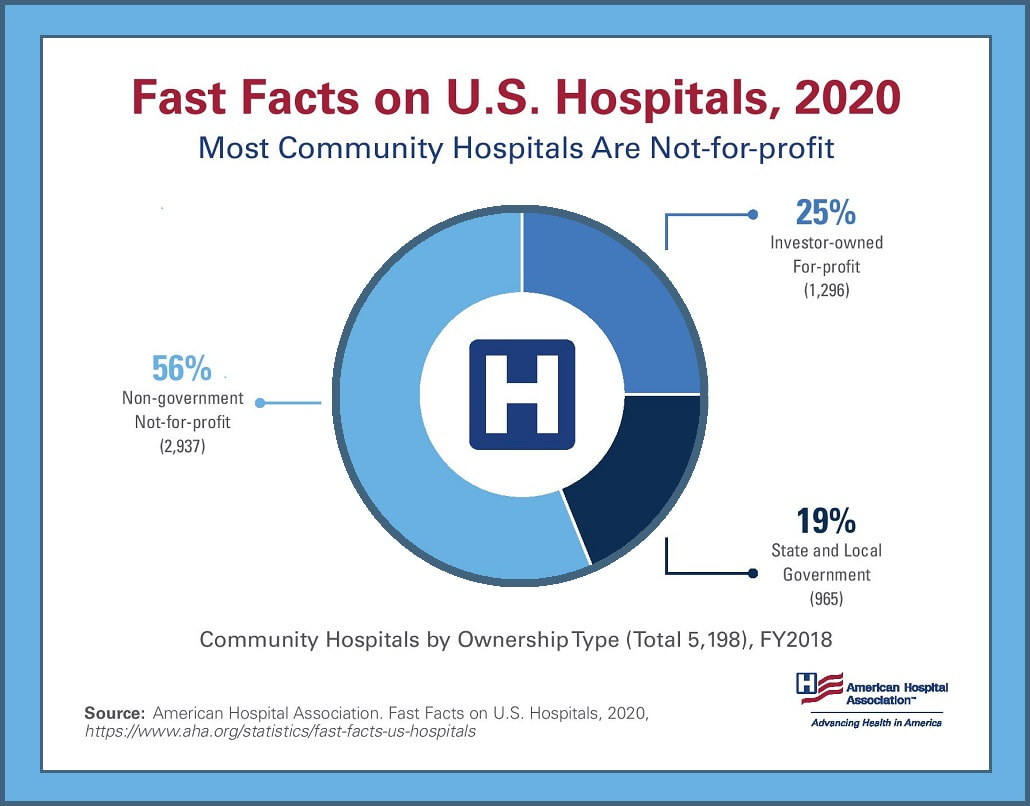

American Hospital Association

Featured Image: Adobe, License Granted

Health Journalism

Healthcare Finance News

Transunion

American Hospital Association

Comments are closed.

Contact Information

Address2150 Lelaray Street

Colorado Springs, CO 80909 P.O. Box 140 Colorado Springs, CO 80901 |

ContactPhone: (800) 266-3809 / (719) 634-3760

Email: [email protected] Business Hours: Monday – Friday, 8am – 5pm Closed Sat/Sun |

Other Information |

Click to set custom HTML

©

2022 Reliant Financial Services LLC