News

|

Shape Divider - Style fan_opacity

|

Want a Top-Performing Practice?

|

|

Today’s healthcare providers face unique challenges when it comes to getting paid. Medical billing is complex and expensive, and the regulatory environment is continually changing. In-house billing and collections requires the average practice to hire at least one or two properly trained medical billers/coders for each insurance provider.

Not to mention the expenses associated with payroll, computer systems and software, record keeping, and staying current with billing and coding requirements. Let's break this down further... Staffing Costs When calculating the cost of business office staff, you should consider the following expenses:

|

Are You Technically Challenged? When deciding whether to keep your medical billing in house or to outsource it, consider the technical ability of yourself and your staff. In-house billing and coding requires an investment in practice management software, as well as frequent staff training. If you’d rather not deal with software upgrades and technical issues, outsourcing is probably the right move. |

Collecting on accounts using in-house staff would also require the following expenditures:

- Computer hardware costs

- Practice management software costs (about $200 per physician per month)

- Clearinghouse fees for direct-claim processing (about $100 per physician per month.

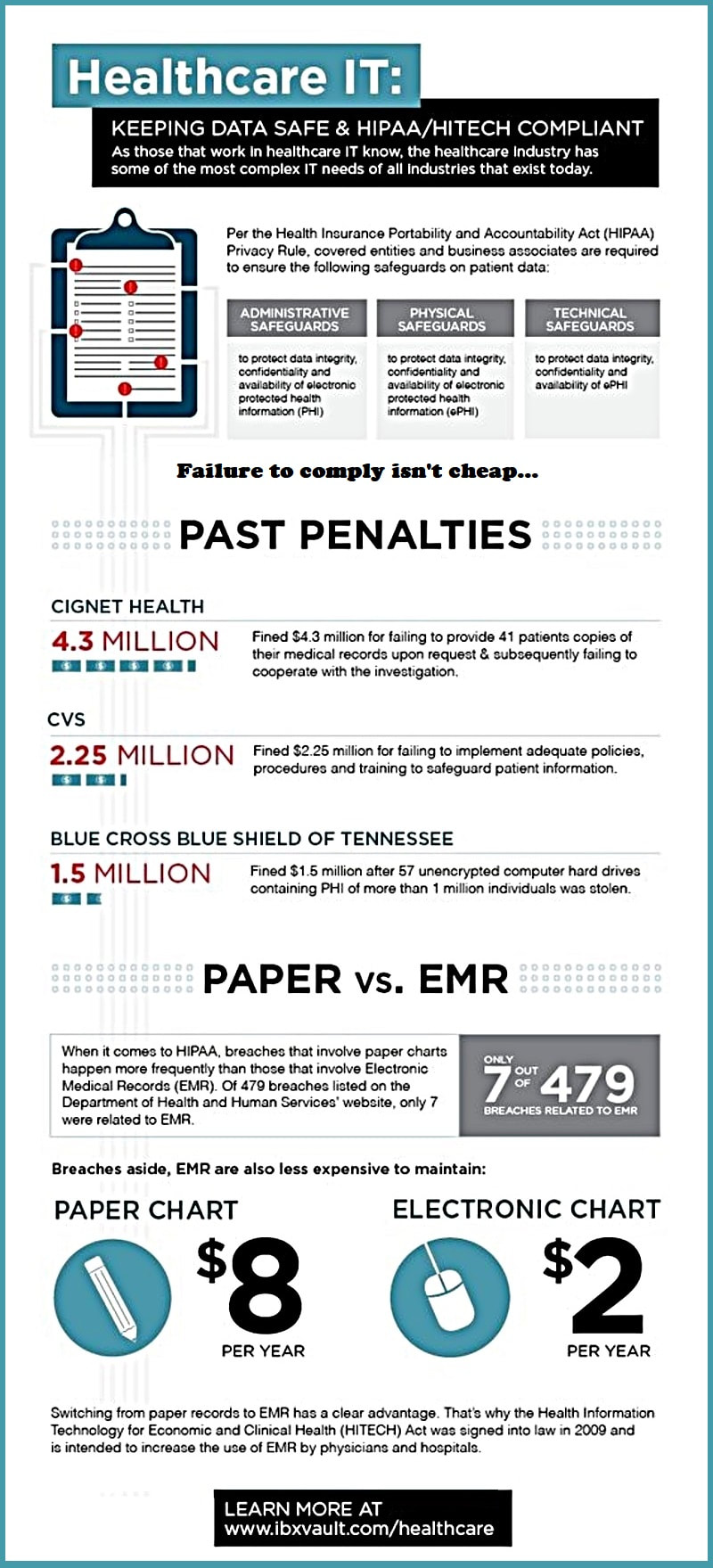

Noncompliance Costs

- The penalty for HIPPA violations can range from $100 to $50,000 per record. As of September 2020, the U.S. Office for Civil Rights (OCR) had settled or imposed penalties resulting in more than $128 million.

- In 2019, the Consumer Financial Protection Bureau was awarded more than $24.7 million in judgments for FDCPA violations.

- Submitting incorrect Medicare or Medicaid claims—even unintentionally--violates the federal False Claims Act (FCA). Penalties for violating the FCA can be three times the amount of the damages.

|

Does Your Practice Have High Staff Turnover? Staff turnover in the healthcare industry is the second highest in the country (exceeded only by hospitality). For small or independent medical practices, turnover in the billing department, can be particularly damaging. Claims processing is the lifeblood of a practice. Changes within the billing team inevitably impair that processing. If your practice experiences frequent office staff turnover, you’ll want to consider outsourcing some or all of your back-office functions. |

Lost Revenue

The Department of Health and Human Services estimated that 42% of all Evaluation and Management (E/M) claims are coded incorrectly.

Medical coding requires a huge amount of work, with billing codes and regulations continually changing. Small administrative errors here and there (missed information, duplicate billing, etc.) can result in denied claims and lost revenue. And then there is the revenue lost when providers fail to effectively collect on self-pay accounts. Did you know that more than 80% of self-pay revenue is generated by about 30% of self-pay accounts? Would your business office staff be able to identify and target the 30% who are likely to pay? Extending the Business Office So you want your medical practice to become a top performer, but you simply don’t have the financial and physical resources needed to adequately invest in your business office. What’s more, every year you’re losing revenue from denied claims and sloppy collection practices. You need a revenue cycle expert who will partner with you to reduce overhead and generate more income. You need an EBO—an extension of your business office. You need Reliant Financial Services. RFS is dedicated exclusively to healthcare financial management. When you partner with RFS, you can expect improved cash flow, reduced accounts receivable, and ensured compliance with governmental regulations. |

Featured Image: Adobe, License Granted

RevCycle Intelligence

Software Advice

360 Connect

PR Web

Contact Information

Address2150 Lelaray Street

Colorado Springs, CO 80909 P.O. Box 140 Colorado Springs, CO 80901 |

ContactPhone: (800) 266-3809 / (719) 634-3760

Email: [email protected] Business Hours: Monday – Friday, 8am – 5pm Closed Sat/Sun |

Other Information |