News

|

Shape Divider - Style fan_opacity

|

Should You Request Upfront Payment?Pre-Payment and Point-of-Service Collections

|

|

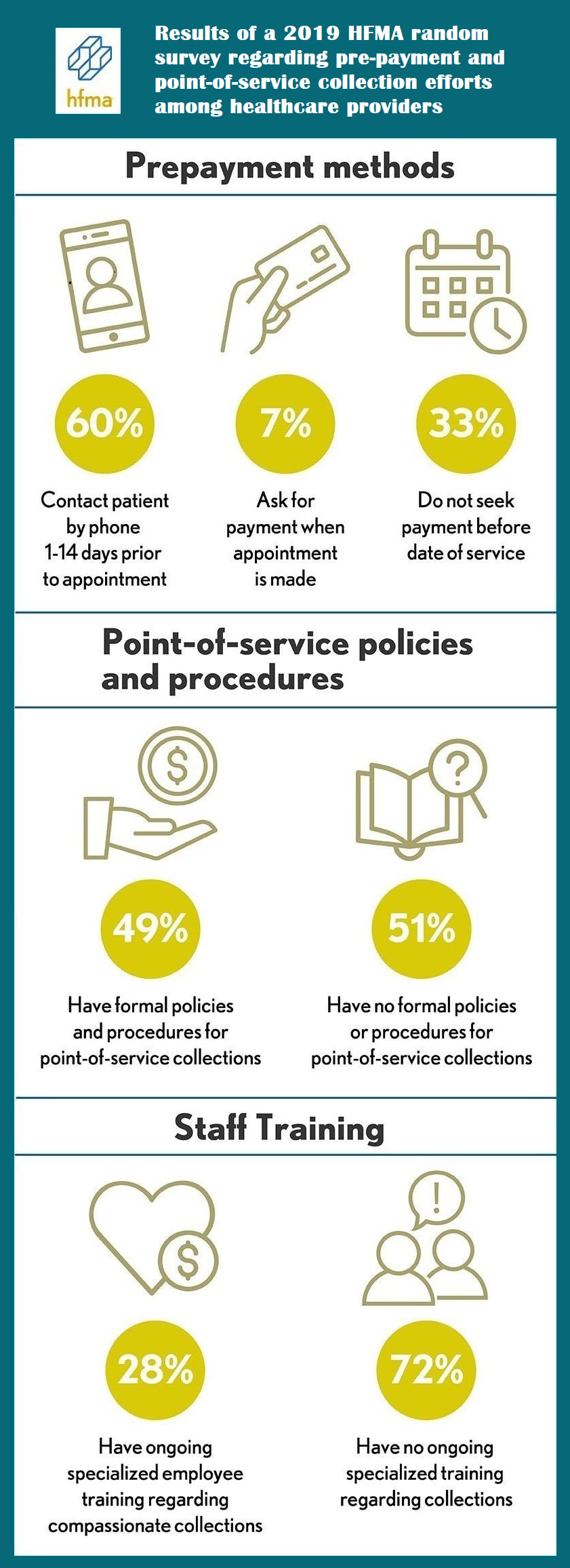

Oftentimes, this amount is simply the insurance copay. But providers are increasingly also requesting at least a portion of the patient’s out-of-pocket cost. Clearly, there's a substantial difference between asking for a $20 copayment and expecting a patient to fork over a $2,000 deductible.

So in order to effectively and compassionately request upfront payments, providers should utilize a combination of technology and training. The technology allows them to accurately estimate a patient’s financial responsibility, and the proper training helps them provide financial counseling and create a workable payment plan. Begin with Accurate Cost Estimates

Healthcare providers can employ a variety of software technologies to help them estimate both the total cost of medical services and their patient’s self-pay portion. These tools can be used to:

Proper Training Is Key

An empathetic, personable approach by staff who have been properly trained can make all the difference when it comes to requesting pre-payment for medical services. Trained staff can offer financial counseling to patients who are unable to manage out-of-pocket expenses on their own.

This counseling largely entails educating patients about basic medical and insurance terminology, and explaining the expense estimation letter. The counselor and patient can then work together create a realistic payment plan. Staff should also be able to advise patients of any financial assistance programs for which they may be eligible. |

Upfront Payment Policy

Make sure your Patient Financial Responsibility Form includes a reference to your upfront payment policy. Explain how your practice operates with regard to point-of-service payments. For example: "We will submit the claim to your health insurance carrier and provide you with a written estimate of your out-of-pocket expenses. Our financial counselors are available to assist you with payment plans." |

Trained staff members should be able to suggest multiple payment options, including:

In light of COVID and the subsequent economic fallout, empathy and compassion are needed more than ever when offering upfront financial counseling. Patient stress levels are running very high. Successful financial counselors will help alleviate that stress, not contribute to it.

- Prompt-payment discounts (20% is considered standard)

- Extended payment periods for high balances

- Flat rates for basic services available to self-pay patients

In light of COVID and the subsequent economic fallout, empathy and compassion are needed more than ever when offering upfront financial counseling. Patient stress levels are running very high. Successful financial counselors will help alleviate that stress, not contribute to it.

--Article Continues Below--

Are You Between a Rock and a Hard Place?

Healthcare provider sometimes feel like they’re between the proverbial “rock and a hard place” when it comes to collecting the patient responsibility portion of their payment.

On one hand, this portion represents a significant chunk of a practice’s overall revenue. It must be collected if the business is to remain afloat financially. But on the other hand, financial stress can have a negative effect on their patients’ health.

By employing the right technology and ensuring their staff is properly trained, healthcare providers can implement an effective upfront payment policy, resulting in fewer bad debts. But in order to avoid jeopardizing their valuable patient relationships, such a policy must be grounded in compassion, applied discreetly, and include financial counseling when necessary.

On one hand, this portion represents a significant chunk of a practice’s overall revenue. It must be collected if the business is to remain afloat financially. But on the other hand, financial stress can have a negative effect on their patients’ health.

By employing the right technology and ensuring their staff is properly trained, healthcare providers can implement an effective upfront payment policy, resulting in fewer bad debts. But in order to avoid jeopardizing their valuable patient relationships, such a policy must be grounded in compassion, applied discreetly, and include financial counseling when necessary.

Sources:

Featured Image: Adobe, License Granted

Tucson.com

HFMA

Nurse Practitioner Business Owners

PatientCo

Featured Image: Adobe, License Granted

Tucson.com

HFMA

Nurse Practitioner Business Owners

PatientCo

Comments are closed.

Contact Information

Address2150 Lelaray Street

Colorado Springs, CO 80909 P.O. Box 140 Colorado Springs, CO 80901 |

ContactPhone: (800) 266-3809 / (719) 634-3760

Email: [email protected] Business Hours: Monday – Friday, 8am – 5pm Closed Sat/Sun |

Other Information |

Click to set custom HTML

©

2022 Reliant Financial Services LLC