News

|

Shape Divider - Style fan_opacity

|

The Value of Patient Financial CounselingUse Patient Financial Counseling |

|

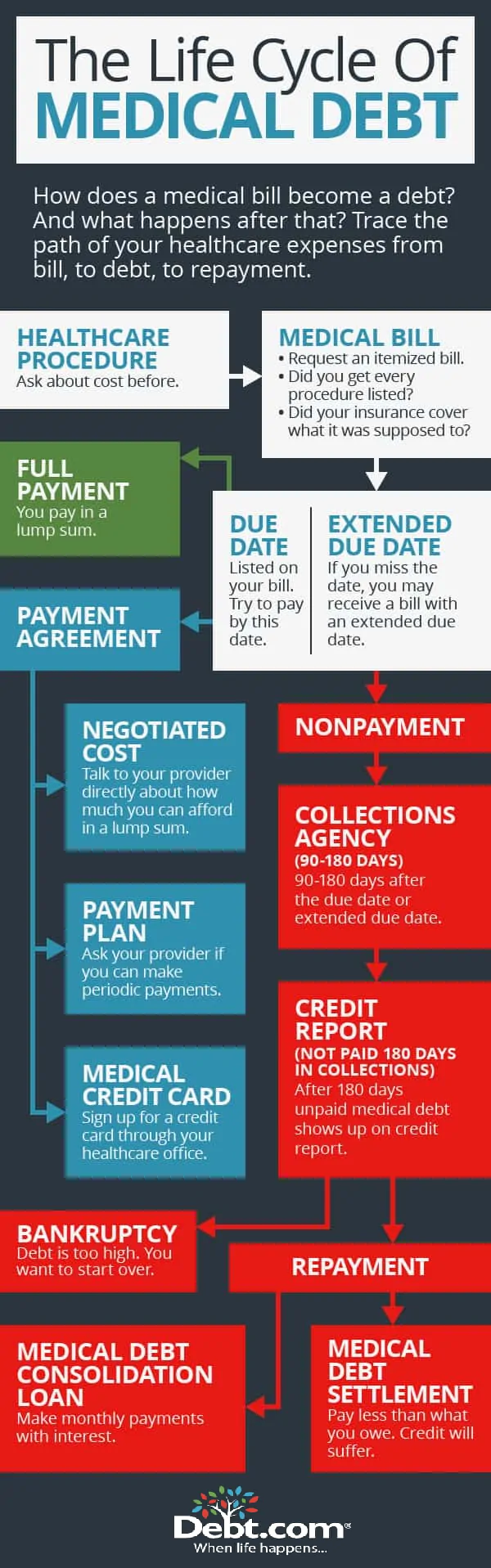

Patients these days must pay a higher percentage of their healthcare costs than ever before. The numbers of both uninsured and underinsured have reached record highs. Today, more than one-fourth of patients who are commercially insured have a high-deductible health plan. A little over ten years ago, that figure was less than 5%. Without financial counseling (and often, financial assistance), many patients face considerable difficulty in covering these costs.

At the same time, healthcare providers recognize that the probability of collecting patient balances decreases significantly after services are rendered. For instance, recent research conducted by Advisory Board indicates that only 36% of patients with a $150 balance will pay the debt in full. By prioritizing front-end financial counseling in non-emergency situations (See box at right), providers can improve their revenue cycle while enhancing the patient experience. Skilled Financial Counselors Are KeyProperly trained and skilled financial counselors who can empathetically communicate with patients about their financial obligations can dramatically affect a provider’s bottom line. By balancing engagement and compassion, financing counseling can result in a higher percentage of point-of-service collections and a better patient experience.

The end result is an increased likelihood of payment in full. In fact, patients are more than two and a half times more likely to pay their balance in full when at least 60% of the estimated financial obligation is paid at the point of service. |

Emergency Services

|

A critical part of front-end patient financial counseling is education. Did you know that only 14% of patients understand basic medical/insurance terminology? A skilled financial counselor who takes the time to explain basic terms and map out a workable payment plan demonstrates concern for patients’ financial well-being as well as their physical well-being.

In addition, trained financial counselors can advise patients about financial assistance they may not be aware of, or encourage them to accept help which they might be reluctant to request on their own.

In addition, trained financial counselors can advise patients about financial assistance they may not be aware of, or encourage them to accept help which they might be reluctant to request on their own.

Multiple Payment Options

Another key factor in effective point-of-service financial counseling is the availability of multiple payment options. When you offer patients many different options for paying their bills, you provide financial counselors with an arsenal of strategies for avoiding bad debt.

--Article Continues Below--

For instance, Advisory Board data shows that offering a prompt-payment discount of 20% (considered standard) provides about a 90% boost in point-of-service collections.

Other payment options can include:

Other payment options can include:

- Increasing the payment period for high balances

- Facilitating pre-payment installments for large, planned medical expenses (such as childbirth)

- Offering flat-rate basic services for self-pay patients

Need Training?

If you’d like to offer your patients financial counseling but don’t feel qualified, Reliant Financial Services can help!

Our professional staff can train yours to become empathetic listeners who can engage with your patients by answering their questions, explaining terminology, identifying possible sources of financial assistance, and devising workable payment solutions—all while maintaining compliance with federal and state regulations.

Our professional staff can train yours to become empathetic listeners who can engage with your patients by answering their questions, explaining terminology, identifying possible sources of financial assistance, and devising workable payment solutions—all while maintaining compliance with federal and state regulations.

Sources:

Featured Image: Adobe, License Granted

Advisory Board

Change Healthcare

American College of Emergency Physicians

National Institutes of Health

Emergency Physicians Monthly

Featured Image: Adobe, License Granted

Advisory Board

Change Healthcare

American College of Emergency Physicians

National Institutes of Health

Emergency Physicians Monthly

Comments are closed.

Contact Information

Address2150 Lelaray Street

Colorado Springs, CO 80909 P.O. Box 140 Colorado Springs, CO 80901 |

ContactPhone: (800) 266-3809 / (719) 634-3760

Email: info@reliantfs.com Business Hours: Monday – Friday, 8am – 5pm Closed Sat/Sun |

Other Information |

Click to set custom HTML

©

2022 Reliant Financial Services LLC